The journey to homeownership isn’t all that easy for many Canadians. Home prices are high throughout the country, requiring prospective buyers to accumulate large down payments in order to achieve their dreams of owning a home.

Fortunately, there’s a new account that can make the path to homeownership easier – the tax-free First Home Savings Account (FHSA).

About the FHSA

The First Home Savings Account is a government initiative designed to help Canadians save for their first home. Prospective first-time buyers over the age of 18 can contribute up to $8,000 every year, to a maximum lifetime limit of $40,000. Any unused contribution room can be carried over to the next calendar year.

Individuals can open multiple FHSAs, which can contain a variety of investment types, such as cash, mutual funds, Guaranteed Investment Certificates (GICs), stocks, bonds and Exchange Traded Funds (ETFs). If you do open more than one account, however, just be sure to keep your total contribution under the maximum annual and lifetime maximums – otherwise, there’s a 1% tax on the highest amount of the overcontribution for the month.

Tax Benefits of an FHSA

The First Home Savings Account comes with several tax advantages. For one, your money grows faster than it would in a traditional savings account because your investment earnings aren’t taxed.

What’s more, your contributions to an FHSA are tax deductible, which means your taxable income will be reduced by the total amount of your contributions in the year you make them. For example, if you earn $75,000 in a year and contribute $8,000 to your FHSA, your taxable income then becomes $67,000. The result is that you pay less tax on your income earned in the year you contribute.

Then, when you’re ready to buy a home and withdraw funds from your FHSA, that money is withdrawn tax-free.

To learn more about a First Home Savings Account, read our article, Everything You Need to Know About the Tax-Free First Home Savings Account, or visit the Tax-Free First Home Savings Account information page on the Government of Canada website.

FHSA Eligibility

To be eligible to open a tax-free First Home Savings Account, you must be a Canadian resident 18 years of age or older. You also must be a first-time home buyer. What does this mean, exactly? For the purposes of the FHSA, a first-time homebuyer is a person who has not owned a home during the current calendar year or the preceding four calendar years, which was their principal place of residence.

In order to take full advantage of the FHSA and withdraw your savings on a tax-free basis, you must still be a first-time homebuyer or have moved into your first home in the last 30 days. If you haven’t yet moved into your new home, you have to show a written agreement to buy or build a qualifying home before October 1st of the year after the withdrawal. In either case the home, which must be in Canada, has to be your principal place of residence within one year of buying or building it.

The FHSA in Action – See How First-Time Homebuyers Can Save More

To help illustrate how a First Home Savings Account works and demonstrate the advantages of investing in one, we have created two fictional scenarios. In each case, the buyer is eligible to open and withdraw from their FHSA, and therefore able to take full advantage of the benefits of the account. Let’s take a look at the homebuying journeys of “Ellie” and “Arjun” and how the FHSA has the opportunity to help them achieve their goals of owning their first home!

FHSA Case Study #1: Ellie

These examples are for illustrative purposes only.

These examples are for illustrative purposes only.

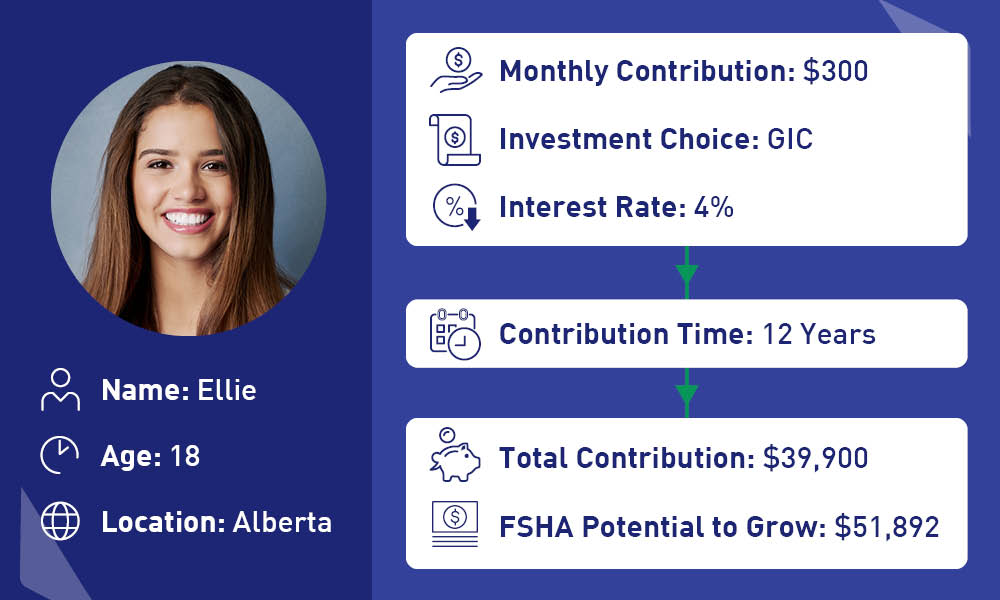

Ellie is an 18-year-old student, living in Alberta. She is single and has a part-time job.

Ellie is a planner and knows she would like to buy a home someday. She believes now is a good time to start saving. Her family agrees!

So, Ellie opens a First Home Savings Account and begins by contributing $300 per month – $150 from her part-time job income and $150 from her family. She keeps up this pattern of saving until she graduates.

Upon graduation, Ellie begins to contribute $300 of her own money every month, for an annual total contribution of $3,600.

Clearly, Ellie is a forward-thinker – but she’s also a bit risk averse. She chooses to allocate her contributions into a GIC for the safety and stability these investments provide. We will assume the average GIC interest rate is 4%.

Each year, Ellie continues to contribute her $300 every month, and when she turns 30, her contributions will have amounted to a total of $39,900 – just shy of the lifetime maximum.

But here’s the best part. Because Ellie chose to save in a First Home Savings Account – and earn tax-free interest on her savings – the total value of her FHSA has the potential to grow to $51,892. That means $11,892 in savings growth!

FHSA Case Study #2: Arjun

These examples are for illustrative purposes only.

These examples are for illustrative purposes only.

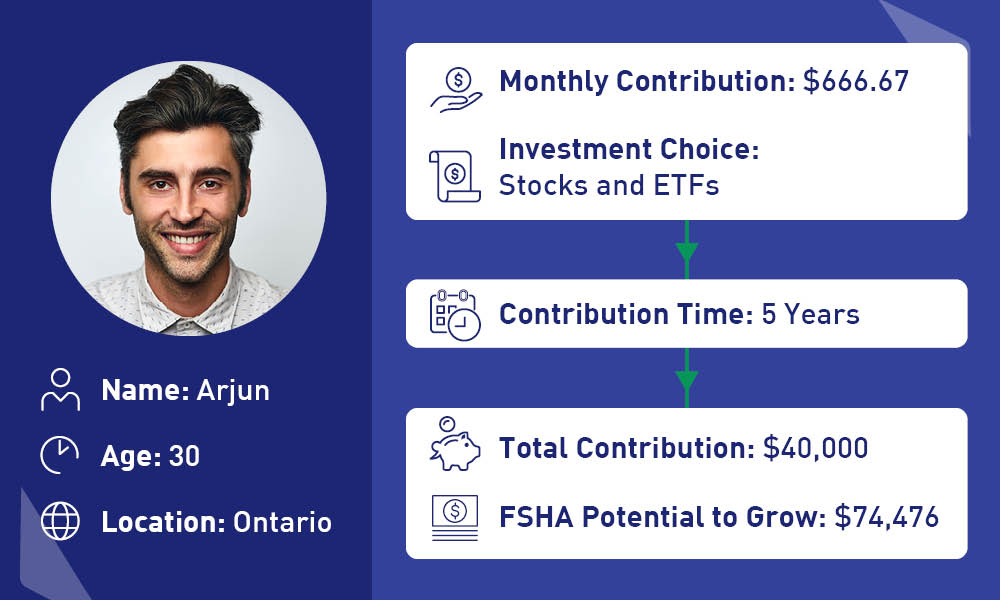

Arjun is a 30-year-old newcomer to Canada. He is engaged, living in Ontario and working as a software engineer.

Part of Arjun’s plan is to buy a home in Canada for himself and his future family in 10 years. He is a dedicated saver and plans to set aside $8,000 of his salary every year for the next five years, which he contributes to a First Home Savings Account. For the following five years, Arjun doesn’t contribute (he has already reached the lifetime maximum contribution limit), but his money will continue to earn interest in the account.

Arjun takes a higher-risk, higher-reward approach to investing and allocates his contributions to stocks and ETFs, which we will assume to have an average annual return of 8%.

In this scenario, Arjun’s investing strategy pays off. In 10 years, Arjun’s $40,000 in contributions will have the chance to grow to $74,476. That’s $34,476 in savings growth and represents an over $10,000 difference between saving in an FHSA versus a taxable account.

By the time he turns 40, Arjun will have a substantial amount of savings that could be used towards a down payment to purchase his first home.

While these scenarios are only fictional examples, they demonstrate the savings growth first-time homebuyers can experience when they contribute to a First Home Savings Account. By offering tax advantages and flexibility in savings options, the FHSA empowers Canadians to take control of their financial future and make them homeowners sooner.