Whether you pay your mortgage once a month, twice a month, every week, or every two weeks, your payment is made up of two main components: principal and interest. Your principal is the amount you borrowed to buy your home and need to pay back to your lender. As your mortgage payments are made, the principal is reduced.

The interest is what your mortgage provider charges for lending you the money. Interest is calculated as a certain percentage of the full mortgage loan.

Breaking down your mortgage payment

When you make a mortgage payment, the portions that go toward your principal balance and interest costs will change over the course of your mortgage. In the early stages of your mortgage, your lender will apply a larger portion of the payment toward interest. But over time, an increased portion will be applied to the principal.

Should you have an opportunity to put down extra money – over and above your regular mortgage payment – this amount is directly applied to reduce the outstanding principal, thereby helping you pay down your mortgage faster.

The impact of payment frequency

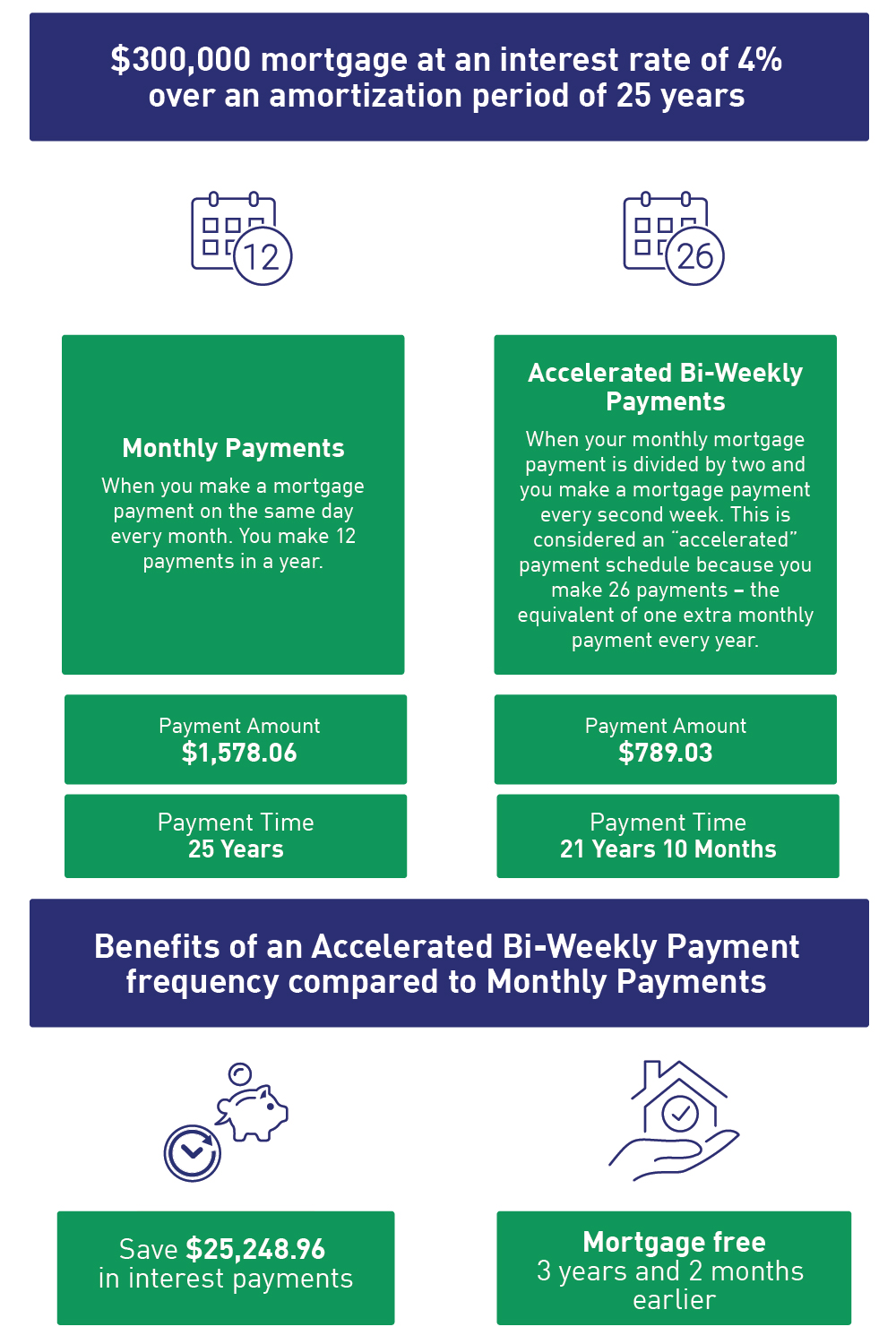

Did you know? The frequency of your mortgage payments can have a meaningful impact on interest costs over the life of your mortgage. MCAP offers monthly, semi-monthly, bi-weekly, accelerated bi-weekly, accelerated weekly, and weekly payment options to help you manage your mortgage according to your lifestyle. By increasing your mortgage payment frequency to an accelerated bi-weekly or accelerated weekly payment option, you end up making the equivalent of one additional mortgage payment each year, which will help pay off your mortgage faster and reduce your interest costs.

For example, on a $300,000 mortgage at an interest rate of 4.00% over an amortization period of 25 years, you would save $25,248.96 in interest payments by choosing an accelerated bi-weekly payment versus a monthly payment. You would be mortgage free after 21 years and 10 months.

Use the MCAP Mortgage Payment Calculator to compare mortgages with different payment frequencies to see how your interest costs can change.

While paying your mortgage involves making a single, regular payment, there is a lot that goes into calculating that payment behind the scenes. Understanding the fundamentals of principal and interest can help you make mortgage decisions that will help you pay less over time and be mortgage-free sooner.