It’s been more than a year since the world began to experience the impact of the COVID-19 pandemic. With changes to how we work, learn, and interact with each other, it’s been a time of adjusting to our ‘new normal’. One area that has seen changes throughout the pandemic is the housing market.

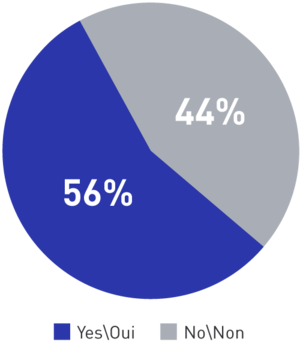

In a recent survey, we asked our homeowners to share their feedback on how COVID-19 impacted their housing decisions. Here’s what we learned from our homeowners and some of the home buying trends we’re seeing in the industry.

1. Undeterred Buyers

While many Canadians were impacted by employment changes due to the pandemic, many people who had planned to purchase a property prior to COVID-19 stuck to their original plan.

| Are you still looking to purchase a home? |

|

According to a report from Mortgage Professionals Canada, this makes sense as “changes in employment take [a] relatively long time to affect home sales, because it takes time to get ready to buy. The people who are buying now have mostly been in stable employment situations for long periods of time.” Additionally, job losses have generally affected those in a younger demographic, aged 15 to 24 (Gen Z), who are typically not in the market to buy homes.

2. Millennials on the Move

Based on a First-Time Homebuyer survey by SAGEN, among Millennials, the pandemic has had a positive impact on their homeownership goals. Unlike Gen Z, over 70% of homebuyers and prospective homebuyers in the Millennial demographic saw no impact to their employment situation during COVID-19. Coupled with fewer opportunities to spend due to various regional restrictions, this group had more disposable income to put towards savings and purchasing a home.

About 50% of millennials surveyed said the pandemic had no impact on their homebuying goals or helped them buy sooner.

3. Changing Housing Situations

One of the major trends for those buying a property during the pandemic was a change in the type of home they were looking for. With more people working and learning from home, the desire for additional space was a top priority. As a result, we’re seeing a shift away from apartment or condominium-style living spaces, and the demand for detached homes rapidly increasing.

| What type of home are you now looking to purchase? | |

|

Larger Home

|

Investment Property  |

|

Smaller Home  |

Secondary Property or Cottage

|

4. Relocating

From the city to the suburbs and even across provincial borders, homebuyers in Canada are relocating to meet their changing needs and lifestyles. According to Mortgage Professionals Canada, “the strongest housing markets in Canada are in the medium sized cities to which people are moving (away from the largest cities).” With the flexibility to work and learn remotely, 16% of those we surveyed have found they no longer need to live in the city and 8% shared they’re no longer looking for a home close to public transportation.

While international migration to Canada has been low during COVID-19, interprovincial migration is picking up.

| Provinces with High Interprovincial Migration [1] [2] | ||

|

Nova Scotia

|

New Brunswick  |

British Columbia  |

5. Low Interest Rates, High Price Tag

It should come as no surprise that low interest rates on mortgages are another factor impacting homebuying trends. But with low rates and increased demand for detached homes, housing prices are on the rise and the market is highly competitive for buyers. As explained by Mortgage Professionals Canada, “even though housing prices are rising very rapidly, very sharp drops in interest rates have resulted in a big improvement in affordability, which is strongly encouraging for homebuying.”

If you’re thinking of buying a home or would like to learn more about MCAP mortgages, get in touch with an experienced mortgage broker near you who can help make the process as simple as possible!

1. Canada's population estimates, third quarter 2020

2. Housing Market Assessment — Canada and Metropolitan Areas