For many Canadians, debt can feel like a never-ending cycle. You pay down a balance, but it creeps back up with day-to-day expenses and sometimes some surprises you didn’t budget for. While your intentions are good, it’s just not that easy to get ahead of your debt. Sound familiar?

Living with debt in Canada is not out of the ordinary – many Canadians carry debt to pay for life’s most important goals. But when it adds up – and you have difficulty bringing it back down – debt can become an emotional and financial burden. While becoming debt free may feel like an insurmountable task at times, with the right plan and approach, it is possible. Here are five tips to manage and reduce your debt, and ultimately achieve financial freedom.

1. Creating a budget with the goal of becoming debt free

|

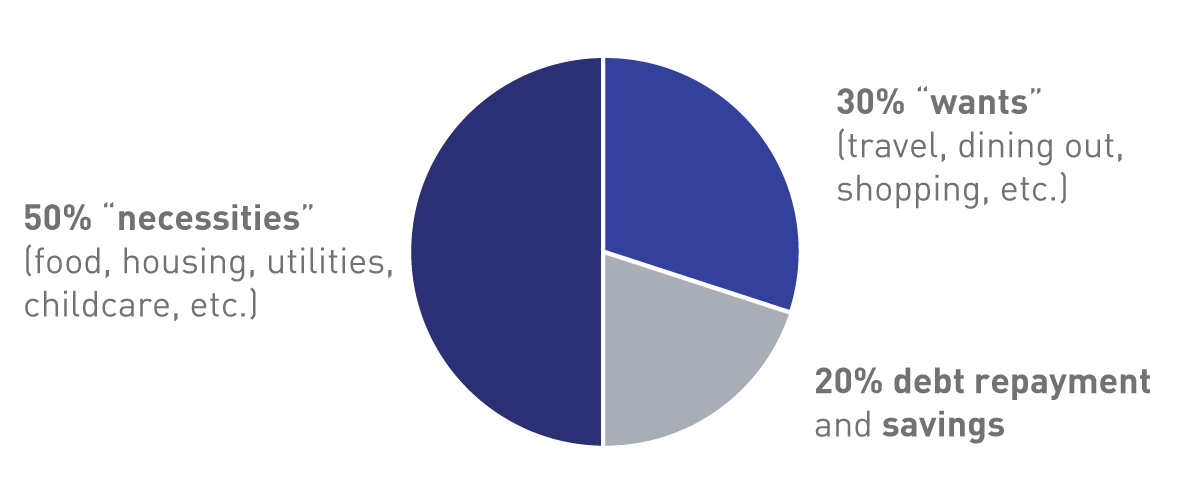

It’s important to know where you stand before you know where you’re going. Starting with a clear view of your financial picture is crucial to understanding what steps you can take to reduce your debt. Creating a budget is a great first move – and budgeting apps can make the process easier than ever. A simple spreadsheet can also be a great starting point for your budget. Start by tracking your expenses for at least a month (having a three-month view is even better) to see where you’re spending your money. Then factor in your income – this can be from your employment, rental income, investment income or any other money you earn and/or receive. Understanding what’s coming in and what’s going out will enable you to live within your means and allocate monthly funds to your debt repayment. Many experts suggest trying the 50/30/20 rule.

|

2. Prioritizing your debts to reduce your interest costs

|

When making a commitment to paying down your debt, it’s best to start with your highest interest rate debt first. In doing so, you will pay less interest in the long run, which saves you money that you can allocate towards other debt. Start by making a list of all your debts with their corresponding interest rate and rank them from highest to lowest. If you have more than one credit card with the same interest rate, start your repayment plan with a lower balance so you can enjoy the feeling of accomplishment that comes with checking one of your debts off your list. Once you pay off your highest interest debt, continue to work your way down your list until you are debt free. And even if becoming debt free feels like a goal that’s farther into the future, paying off high interest rate debts and continuing to make payments on your other balances will contribute to a healthier credit score, which may help you qualify for lower rate solutions. |

3. Considering consolidation solutions to support your debt free goal

|

Becoming debt free in Canada is made easier thanks to the range of financial solutions available to support you. Combining multiple debts into one loan or payment offers several benefits. For one, by consolidating your debt into a single balance, your debt can feel more manageable – there’s just one payment to make, which can help you feel more in control and focused on your goal. Also, most consolidation solutions offer lower interest rates than you would find on a typical credit card – so if you have credit card debt, you will likely reduce the interest you’re paying every month by consolidating. Consolidation loans, lines of credit, balance transfers and mortgage refinancing are all options worth considering. |

4. Negotiating with lenders – they may be more supportive than you think!

|

It may surprise you to learn that lenders are often willing to negotiate with customers who want to make arrangements to better manage their debt. During the pandemic, several lenders were willing to make accommodations for clients who were struggling with debt, and many have carried this approach through to everyday practices. It’s worth contacting your creditors to see if they can assist by lowering interest rates or reducing your monthly payments. It’s important to go into these discussions knowing exactly what you can afford each month – so having your budget prepared first is a must! |

5. Reducing unnecessary expenses to free up cash for debt repayment

|

This step involves taking a close look at your budget again to see where you can reduce or eliminate expenses. This can involve everything from cancelling subscriptions you don’t need or use, cutting back on dining out, or downsizing your living conditions. Be sure to consider all your expenses – down to that daily coffee you buy or the Uber ride you take to meet a friend (instead of taking public transit). Remember, every dollar counts, so determining what you really need to be spending your money on – and what current expenses don’t fall into that category – can make a big difference to your debt repayment plan over time. Life can get expensive, and managing the costs that come with both day-to-day life and your goals for the future can easily lead to more debt than you’re comfortable carrying. While the task of reducing your debt may feel overwhelming when you break it down into manageable steps, the prospect of being debt free can become much more realistic. What’s more, the financial system in Canada offers ways to support your debt free goal through consolidation solutions, lenders that may offer repayment flexibility and budgeting tools that are designed to enable your success. Plus, boosting your financial literacy can also help you develop healthy spending and saving habits and keep you from falling into debt again. |

Connect with an MCAP Expert Today

Are you an MCAP homeowner? Contact us with any questions you may have.